Introduction

Planning for retirement is a crucial aspect of financial security, yet many individuals face a retirement gap – the disparity between their retirement income needs and available resources. This shortfall can be daunting, but with strategic planning and the right financial tools, it is possible to bridge the gap and achieve a comfortable retirement. In this blog post, we will explore practical tips and actionable insights to help you and your clients navigate the retirement deficit and secure a financially sound future.

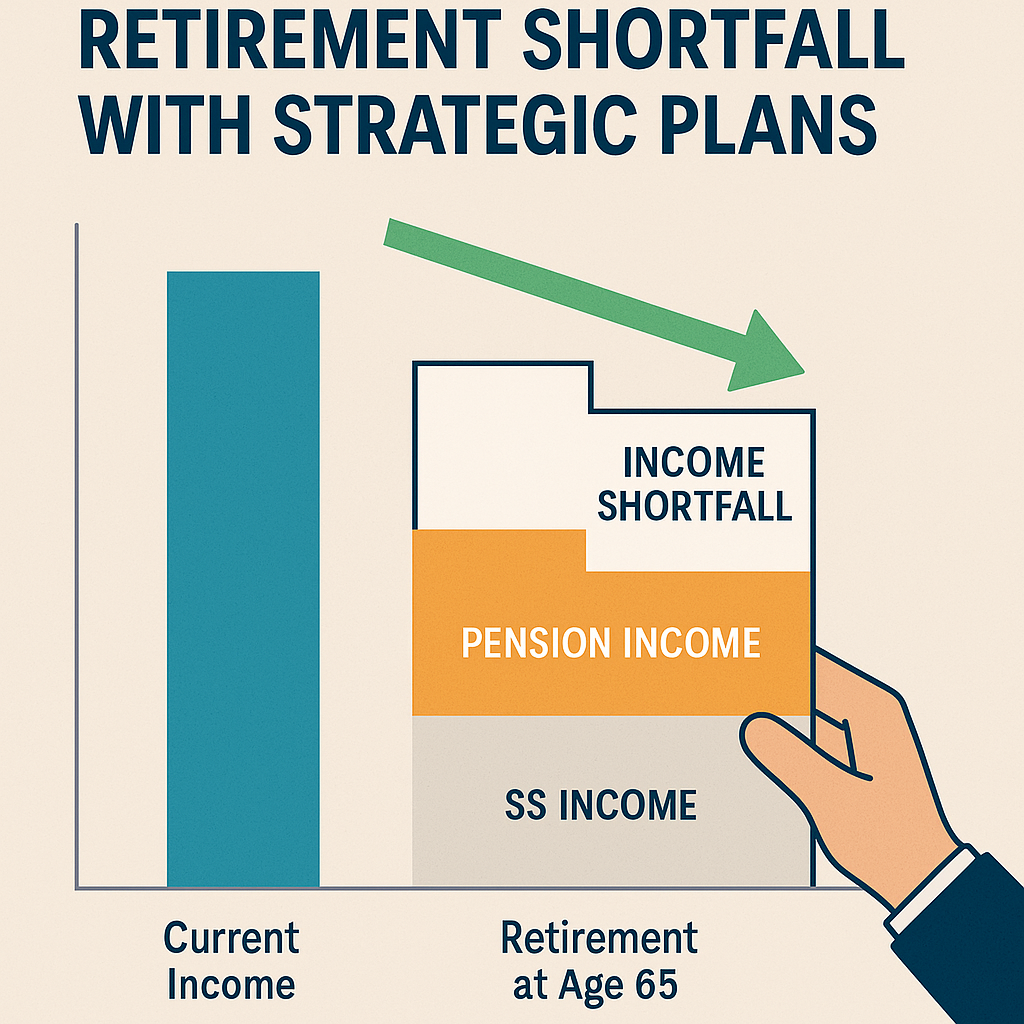

Understanding the Retirement Gap

Before delving into solutions, it's essential to understand the factors contributing to the retirement shortfall:

- Increasing life expectancy: People are living longer, which means retirement savings need to last longer.

- Declining pension coverage: Traditional pensions are becoming rare, shifting the responsibility of retirement savings to the individual to save on their own.

- Inadequate savings: Many individuals are not saving enough for retirement due to various reasons such as low income, competing financial priorities, or lack of financial knowledge.

- Social Security gap: Social Security benefits alone may not be sufficient to cover all retirement expenses, leaving a gap that needs to be filled.

Strategies to Bridge the Retirement Gap

1. Start Saving Early and Consistently

- Start saving for retirement as early as possible to take advantage of compound interest.

- Set up automatic contributions to retirement accounts to ensure consistent savings habits.

2. Diversify Investments

- Spread retirement savings across different asset classes or index options to reduce risk and maximize returns. Consider incorporating annuities into the investment portfolio for guaranteed income in retirement.

3. Maximize Retirement Account Contributions

- Contribute the maximum allowable amount to retirement accounts such as 457(b)s, 403(b)s, 401(k)s, IRAs, Roth IRAs, and annuities to benefit from tax advantages and boost savings.

4. Consider Life Insurance as a Retirement Planning Tool

- Permanent life insurance policies provide a death benefit for loved ones as well as a tax free income to help bridge your retirement income gap. Explore indexed universal life insurance, which offers the potential for cash value growth linked to market performance without downside risk.

5. Evaluate Social Security Strategies

- Work with a financial professional to optimize Social Security benefits by considering factors like claiming age, spousal benefits, and survivor benefits. Delaying Social Security benefits can result in higher monthly payments, especially for those in good health with longevity expectations.

Next Steps for Closing the Retirement Income Gap

As you navigate the complexities of saving for retirement and strive to close the retirement shortfall, consider partnering with a financial professional and/or insurance agent who specializes in retirement savings options. These professionals can offer personalized guidance, tailored solutions, and help ensure you have sufficient income to enjoy your retirement years.

Conclusion

The retirement income gap is a significant challenge, but with strategic planning and the right financial tools, it is possible to address this shortfall effectively. By implementing the actionable tips outlined in this blog post, you can take proactive steps towards securing a comfortable and financially stable retirement. Don't wait until retirement is on the horizon – start planning today to ensure a prosperous tomorrow.

Ready to take charge of your retirement planning? Contact Universal Retirement today (702-968-8352) to learn how we can help you close the retirement income gap and secure a brighter financial future.