Introduction

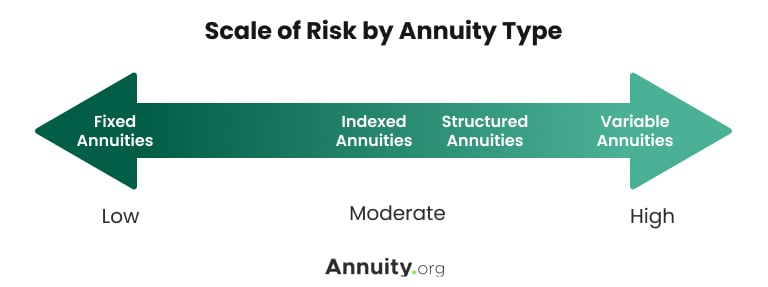

Navigating the world of annuities can be overwhelming, especially when deciding between fixed and variable options. As you plan for retirement and seek to secure your financial future, understanding the differences between fixed and variable annuities is crucial. In this comprehensive guide, we will explore the key features, benefits, and considerations of fixed and variable annuities to help you make informed decisions that align with your retirement goals.

Fixed Annuities: Stability and Predictability

Fixed annuities offer a guaranteed rate of return over a specific period, providing stability and predictability in your retirement income. Here are some key points to consider:

- Fixed Rate of Return: Fixed annuities offer a predetermined interest rate, ensuring that your investment will grow at a steady pace.

- Safety and Security: Your principal investment is protected from market fluctuations, offering a secure option for risk-averse individuals.

- Income Stream: Fixed annuities can provide a steady income stream during retirement, offering peace of mind and financial security.

Variable Annuities: Potential for Growth and Flexibility

Variable annuities, on the other hand, offer the potential for higher returns but come with greater risk due to market fluctuations. Here are some key insights to consider:

- Investment Options: Variable annuities allow you to invest in a variety of sub-accounts, offering potential growth opportunities based on market performance.

- Risk Exposure: Unlike fixed annuities, variable annuities expose your investment to market risks, which can lead to fluctuations in your account value.

- Flexibility: Variable annuities offer flexibility in investment choices and the potential for higher returns, making them suitable for individuals willing to take on more risk.

Which Annuity is Right for You?

When deciding between fixed and variable annuities, consider the following factors:

- Risk Tolerance: Assess your risk tolerance and investment objectives to determine which type of annuity aligns with your financial goals.

- Income Needs: Consider your income needs during retirement and choose an annuity that provides the desired level of income security.

- Market Conditions: Evaluate the current market conditions and economic outlook to make informed decisions regarding fixed or variable annuities.

Making Informed Decisions

To make the best decision for your retirement income strategy, consider the following tips:

- Consult a Financial Professional: Seek guidance from a financial advisor who can help you evaluate your options and create a customized retirement plan.

- Diversify Your Portfolio: Consider diversifying your investments to balance risk and return, incorporating both fixed and variable annuities where appropriate.

- Review and Adjust: Regularly review your annuities and retirement plan to ensure they align with your changing financial goals and objectives.

Conclusion

Understanding the differences between fixed and variable annuities is essential for building a secure retirement income strategy. Whether you prioritize stability and predictability with a fixed annuity or seek growth potential with a variable annuity, making informed decisions based on your financial goals is key. Take the next step towards securing your retirement income by consulting with a financial professional at Universal Retirement to explore the best annuity options tailored to your needs. Your future financial security starts with informed decisions today.